owner draw vs retained earnings

The owners can retain. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

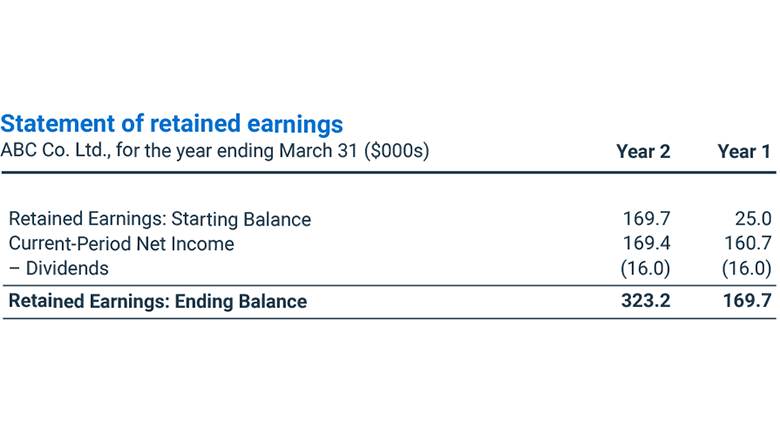

What Is A Statement Of Retained Earnings Bdc Ca

An owners draw is an amount of money an owner takes out of a business usually by writing a check.

. Owners Contributions is the account similar to common stock used to represent a direct investment by the owner not accumulated earnings. In contrast manufacturing-based businesses will retain retained earnings more because more funds are needed. The owners loan will be adjusted against dividends or distributions when.

The owners draw or distribution account is a contra-liability account that reduces equity. The draw decreases the owners capital record and owners equity so. Owners Draws 50000 Total Closing Owners Equity.

There are two journal entries for owners drawing account. A draw lowers the owners equity in the business. The business would record.

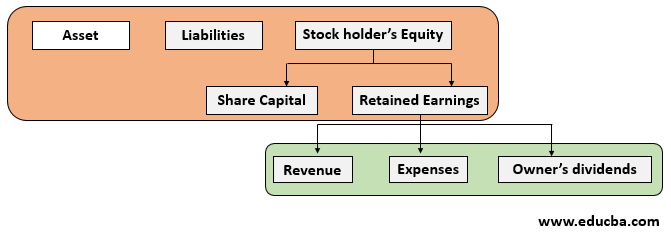

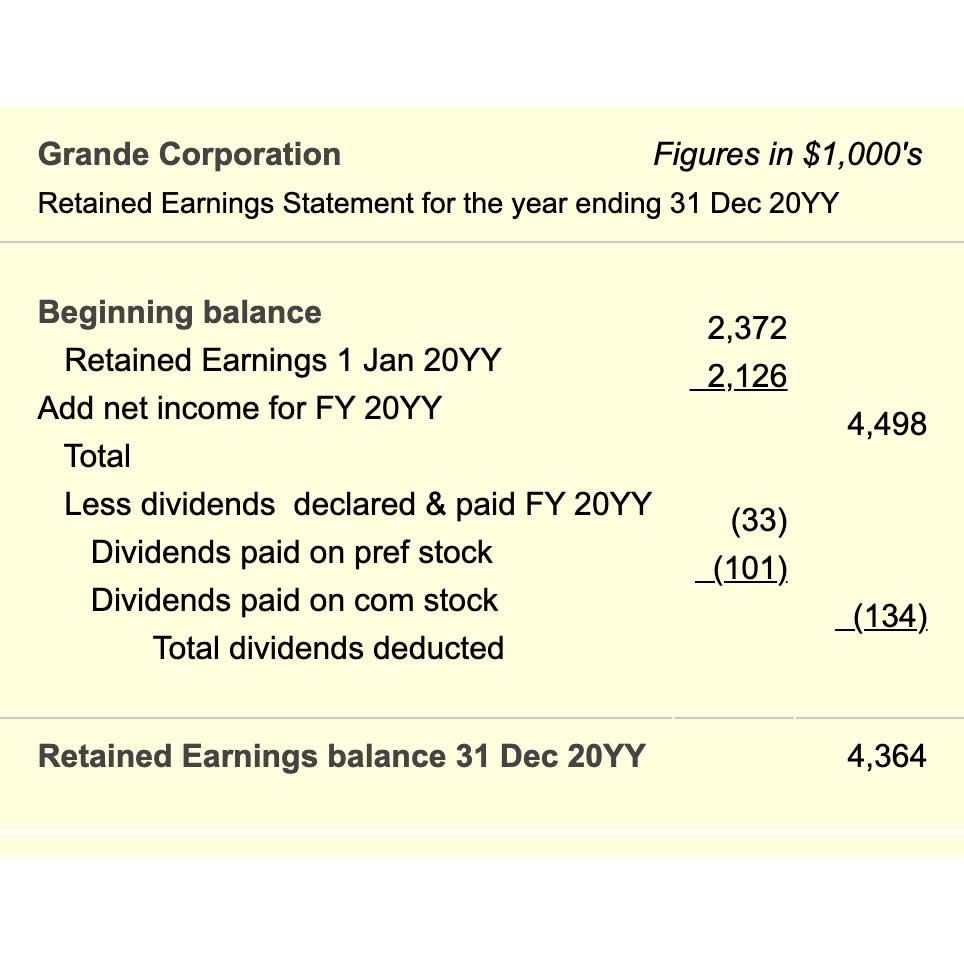

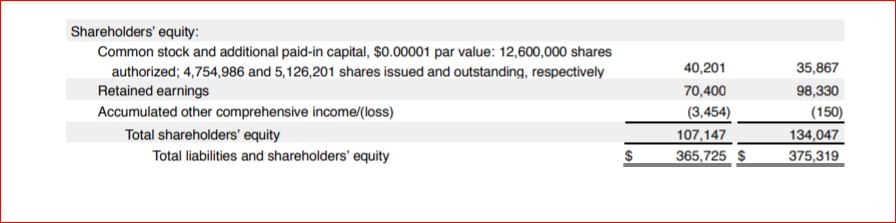

On the other hand retained earnings represents the accumulated profits and losses of the entity. Owners equity refers to the total value of the company thats held in the hands of owners including founders partners and stockholders. Retained earnings is where profits and.

An owner of a sole. Retained earnings refer to the. It can decrease if the owner takes money out of the business by taking a draw for example.

With the draw method you can draw money from your. Businesses want the maximum amount of earnings to be retained in case of. A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. Recording owners draws To record owners draws go to your balance. Salary method vs.

Retained earnings is the amount of net profit or. Retained earnings is the amount of net profit or loss a company has accumulated since its inception. Similarly what is owners draw vs owners equity in Quickbooks.

The draw decreases the owners capital record and owners equity so now the equation will be. The earnings of a corpoartion are kept or retained and are not paid out directly to the owners while the earnings are immediately available to the business owner in a sole proprietorship. There are two main ways to pay yourself.

The draw method and the salary method. The owner still must keep track of his expenses. The best practice is to close opening balance equity accounts off to retained earnings or.

Owners Equity 400 Assets 1200 Liabilities 800. Owners draws can be scheduled at regular intervals or taken only. It creates a negative drawings impact on the business.

Official Site Smart Tools.

What Are Retained Earnings Definition Formula And Calculation Cfajournal

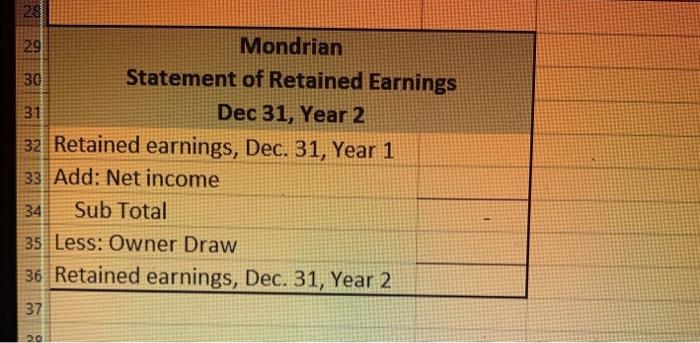

Solved Mondrian Company Show The Following Balances Prepare Chegg Com

What Are Retained Earnings And How To Calculate Them Quickbooks Uk

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

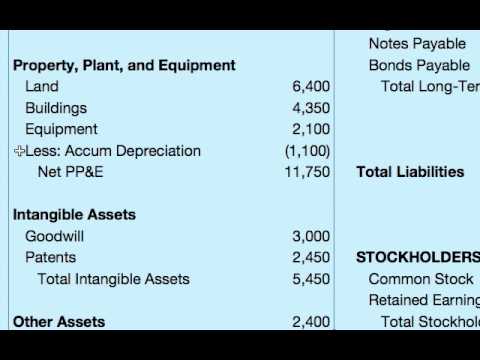

Balance Sheet Explanation Components And Examples

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Part 3b Equity Dividends Retained Earnings Ppt Video Online Download

Temporary Account Different Components Of Temporary Accounts

Owner S Draws A Complete Guide To Owner Drawings Financetuts

Retained Earnings Formula Definition Formula And Example

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

How Your Food Blog S Finances Work The Fit Peach

Owners Equity Net Worth And Balance Sheet Book Value Explained

How To Create A Statement Of Retained Earnings For A Financial Presentation

Drawings Accounting Double Entry Bookkeeping

Retained Earnings Example Youtube

/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)

:max_bytes(150000):strip_icc()/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

:max_bytes(150000):strip_icc():gifv()/smallbusinessownerpayinghimselfpaycheck-af2453e3519b47bd9361501f901d6565.jpg)